My how much is car insurance blog 4227

All about 10 Ways To Lower Car Insurance Costs - Policygenius

Why Is My Automobile Insurance Expensive? Your vehicle insurance coverage is a reflection of you.

DUIs have a big unfavorable impact on your insurance coverage, and in some cases, it can really void your insurance coverage. While that comparison may be out of the world of reality for many, it stands as an excellent example of how the make, design, and type of vehicle affect your premium.

How Can I Lower My Car Insurance Coverage? There's nobody tried-and-true method of lowering your cars and truck insurance expense because your particular protection, your driving history, place, type of car, and a host of other variables all play parts in the last monetary toll - credit. The Drive can just provide a few different choices to either begin to lower your premiums or minimize your monthly bill.

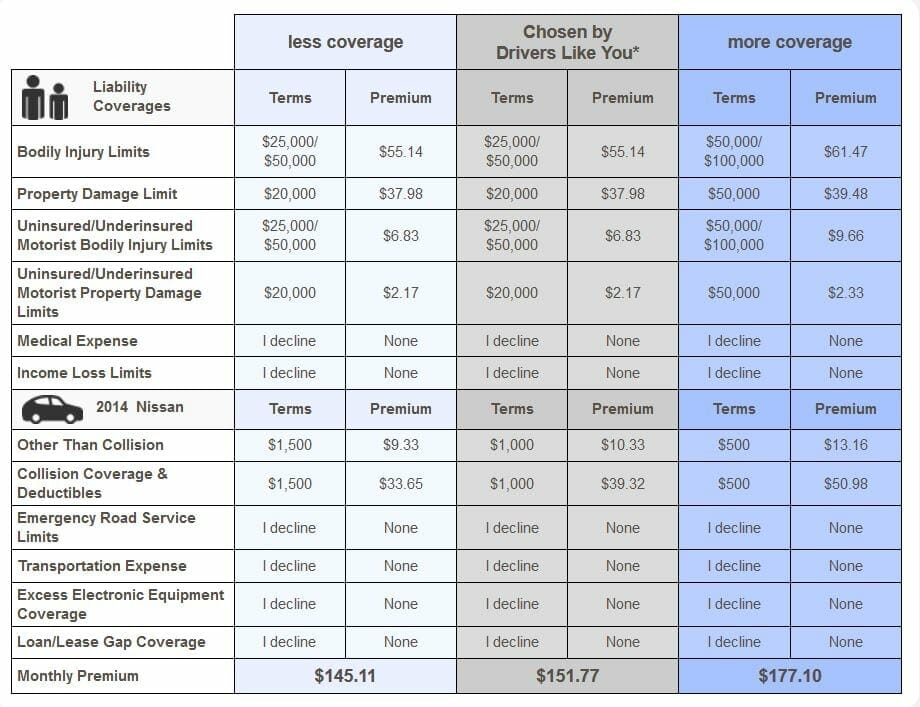

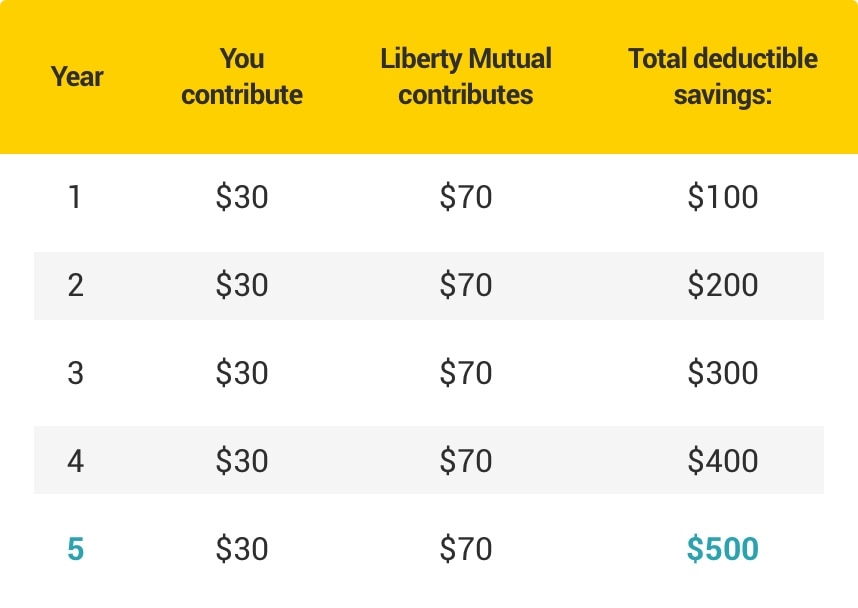

Picking Greater Deductibles, When choosing coverages, you can also pick greater deductibles to reduce your month-to-month cost. By doing so, you increase the quantity of out-of-pocket expenditures in the occasion of an accident - low cost. There are benefits and drawbacks to this, as not everybody will have a few thousand dollars in cost savings if the worst were to take place (car insurance).

It will also vary in terms of pricing according to the aspects and variables detailed above, as well as insurance coverage providers, and discount rates readily available. Do your research, search, and ensure you're correctly covered when the hand of fate deems you not worthy that day. Discover more about this kind of insurance with our guide, What Is Liability Auto Insurance?What Should I Spend for Automobile Insurance? Just how much you spend on automobile insurance will depend upon the coverages you select, the variables above, and which insurance coverage service provider you go with. With top-rated insurance providers to select from, Virginia CU Insurance coverage Services works hard to supply you the protection you require at costs you can afford. Lower vehicle insurance coverage. All of us desire it, however how can you in fact get cheaper rates? Whether you're a skilled chauffeur, a newbie motorist, have a poor driving history, and even a perfect driving record, look no further! We have actually got some valuable tips on how to reduce cars and truck insurance premiums. This guide to lower rates is for everybody from those having trouble paying for vehicle insurance coverage to those simply wanting to save some money. And if you fall under the high-risk chauffeur category, it might be cleaned after 10 years. Some states even enable you to take protective driving courses, or traffic school to help enhance your driving record. Trying to find methods to be a safe motorist? Click for safe driving suggestions!.?.!! Consolidate your vehicle insurance coverage policies. Direct Automobile Insurance offers a multi-product insurance discount of up to 5%if you buy an extra certifying product like term life insurance coverage . And a multi-car discount rate that might save you up to 25%on your automobile insurance. Drive the least pricey automobile to guarantee. Considering purchasing a cars and truck? Before you begin shopping, estimate which lorries typically have the most affordable insurance rates. Vehicle insurer generally think about factors like just how much it would cost to repair or replace the vehicle, the frequency of events or claims with the car model, how much damage the lorry can cause, what safety functions are included, and how much horsepower it has. Your best choice? Get a car insurance quote or 2 for the vehicle (s)you have an interest in buying and see which is the cheapest.

Some insurance companies, like Direct Car, objective to make month-to-month vehicle insurance payments more affordable. We'll help you have peace of mind with the most affordable car insurance coverage possible! Looking for ways to lower the cost of your car insurance coverage?

Contact your car insurance coverage service provider and attempt to work out a much better price. You can keep automobile insurance rates low by simply changing providers or negotiating prices every couple of years.

4 Tips To Lower Your Car Insurance - Country Financial Things To Know Before You Get This

Raising your deductible can save you so much cash on premiums that you'll likely still spend less cash every year, even if you hit your deductible during the year., though you in some cases have to ask about them.

If you end up requiring to file a claim however you're not totally covered, your claim could be rejected - affordable auto insurance. Avoid the payment plans Payment plans can help a great deal of people by spreading out the cash that needs to be spent on insurance coverage (cheap insurance). The drawback is, the majority of auto insurer charge more cash if you pay in installations than if you spend for your coverage all at as soon as.

Having cars and truck insurance coverage is necessary, however rates often increase over time and it prevails to pay too much. None of these suggestions will make your cars and truck insurance coverage free, however they can make it more affordable so that you can get the coverage you need for an affordable price. insured car. Find low premiums with Jerry The outright quickest way to alter your premium is to change insurance carriers.

Try to find changes, You 'd be surprised to discover how numerous individuals are spending for family chauffeurs that haven't lived in your house for several years. cheaper auto insurance. Or sometimes, home members such as teens and young people might have aged out of more costly protection and now receive cheaper vehicle insurance.

Raise your deductible, If you're a consistently safe driver, you'll likely never need to file an insurance coverage claim or pay a deductible. If you're not knowledgeable about the deductible, it's the quantity you pay of pocket prior to your insurance provider pays the remainder of the claim (laws). Most policies have a deductible of roughly $500.

She shares: "One of my favorite methods for drivers to lower cars and truck insurance expenses without losing coverage is "bundling (cheap insurance)." This simple method needs you to buy several types of policies, such as auto and homeowners or tenants from the exact same carrier. Insurers want more of your business, and they reward you for having multiple lines of protection or perhaps having more than one cars and truck on a policy."Inspect out what the leading insurance providers will provide you when you choose multi-line discount rates or bundling.

Ensure you're comparing companies by comparable policy specifications (auto insurance). Check out the fine print on the quotes to make sure the limitations, hazards covered and deductible amounts are the same. If you find that switching automobile insurance might conserve you substantial cash, do a little research about the company prior to you do something about it.

7 Simple Techniques For Does Car Insurance Go Down At Age 25? - Valuepenguin

Your existing insurance provider may provide to match the cheaper vehicle quote (or offer you with a bigger discount rate) to keep your business. cheaper car. Other factors to consider and ways on how to lower cars and truck insurance coverage The quick fixes to drop your car insurance coverage now are effective but a long-term method is needed for insurance coverage savings gradually.

In this post: In the existing monetary unpredictability surrounding the COVID-19 pandemic, you may be looking at different ways to cut your expenditures. cheap insurance. One way you can save money is by decreasing your auto insurance coverage premiums. With fewer Americans on the roadway, some car insurer are offering a variety of discounts, some of which will let you begin conserving cash instantly.

Contact Your Insurance Agent, Start by contacting your current automobile insurance coverage company to ask how you can trim your premiums. Have a copy of your insurance coverage ready so you can see precisely what your current protection includes. The insurance coverage agent must be able to recommend several alternatives (accident).

, understand that the cost of insurance coverage can differ extensively depending on your vehicle. Some vehicles are more complex to repair, more susceptible to theft or more easily harmed than others.

https://www.youtube.com/embed/hQ3V0DLhcYs

If you're leasing a vehicle, it might be an excellent idea to get gap protection, which pays the distinction in between the value of the automobile and the amount you owe on your lease in case the automobile is taken or totaled in a mishap. No matter how much you're presently paying for cars and truck insurance, reviewing your insurance coverage every year might help you recognize ways to conserve. insurance.

10 Easy Facts About Geico: Wildcard - Northwestern University Explained

insurance companies insurers vans insurance affordable

insurance companies insurers vans insurance affordable

Prevent any protection voids by choosing a start date for your new policy that is one or two days prior to your cancellation day Use your existing plan as a rubric for your brand-new policy. Determine features that you value in your current policy and confirm they are used in your new policy Make certain your brand-new provider offers reliable 24-hour solution, Where to start? Answer a few concerns and also obtain FREE plan quotes in an instant (cheap insurance).

If you prepaid for a 6 month or twelve month plan, you will likely have no concern when requesting a refund. low-cost auto insurance. If, however, you are on a month-to-month strategy, you may not be qualified for a refund. The only method to recognize for certain is to call your insurance coverage representative and also request for assistance (insurance).

This thorough Geico cars and truck insurance coverage evaluation will help you in making the final decision. Geico was established in 1936 as well as is the second-largest auto insurance policy company in the nation.

Collision Protection This provides protection to the cost of repair work of your auto after it has actually been harmed in a crash, no matter of whose mistake it was. Geico Comprehensive Insurance coverage This coverage covers the damages to your car that has been created due to vandalism, burglary, dropping things, fire, floodings, severe weather, and pets. vehicle.

Geico Rental Automobile Insurance coverage Coverage the company additionally covers the rental cost when your automobile is in the repair service store. The quantity daily limitation differs as per the plan you have purchased (auto). Mechanical Malfunction Insurance policy this covers the cost of repairs for all the mechanical troubles in a vehicle that has much less than 15,000 miles or is much less 15 months old.

The protection is eco-friendly for about 100,000 miles or seven years. Apart from the insurance coverages discussed above, there are lots of offers as well as discounts used by the firm.

Missouri Woman Sues Geico After Contracting Std During ... Things To Know Before You Get This

The business got fewer than the expected number of complaints to the state regulators, which suggests that the consumer fulfillment is generally higher in contrast with other auto insurance policy companies. Geico has obtained ordinary ratings for case fulfillment, which is better than the majority of its rivals. The monetary security of the business has been ranked instead strong with S&P score it AA+ as well as BM Best score it A++.

It has actually gotten typical scores with Count on, Pilot and Consumer Matters, yet these scores are still greater when compared with the ratings received by lots of other vehicle insurance firms. 1. 9 stars2 celebrities, A+T below are several very easy methods for existing and also prospective policyholders to contact the business (vehicle).

The site likewise has a digital chatbot that aids clients with standard concerns. You can likewise email them, mail them, tweet them, or undergo the information provided on the website. Geico can also be gotten to with their mobile app. Other than that, you can obtain in touch with the agent near you to resolve your problem.

Geico's internet site is very easy to use and also is loaded with valuable info. You can swiftly obtain a quote on any type of insurance you desire on the website, make a settlement, and also also submit or track an insurance claim. The website can also assist you in finding a gasoline station local to you.

It is taken into consideration one of one of the most tech-savvy vehicle insurance carriers in the country. The ordinary national depictive price of Geico cars and truck insurance coverage is $1,168, that makes it among one of the most pricey vehicle insurance available - insurance companies. Naturally, the total amount depends on various variables, including your age, driving document, as well as more.

Additionally, Geico uses more cost effective rates than Modern. Modern offers Telematics and Homeowner discounts that are not provided by Geico. On the other hand, Geico supplies Air Bags, Anti-Lock Brake System, Defensive Driver, Excellent vehicle driver, and also Fondness Membership Alum discounts. If you have inadequate credit rating, then Geico is a far better alternative for you as compared to Progressive.

The Facts About Geico Auto Insurance Review 2022: Pros And Cons - Nerdwallet Uncovered

, negligent driving infraction, ticket, or an at-fault accident, after that Geico is a great choice for you. When it comes to prices, Geico is extra budget friendly than Allstate.

State Ranch has actually been rated among the top for customer support. Geico is well-known for its budget-friendly rates and outstanding price cuts. Geico is a far better choice than State Ranch if you have a poor credit history. The company likewise uses much better prices for drivers with an extraordinary credit score. For chauffeurs with a DUI, negligent driving infraction, ticket, or an at-fault accident in their driving record, Geico is an excellent choice.

Requirements for insurance discount rates vary by state. If you mean to take this course for insurance policy discount rate, you should verify with your agent or insurer prior to you register that they will accept the DDC-Online Certificate of Conclusion issued by the National Safety And Security Council. Considering that just one certification will certainly be released to each account, member of the family will need to purchase separate accounts to receive the certificates of their very own. car.

GEICO Customer Care, Long time customers have a tendency to be much more satisfied with the client service and insurance agents than brand-new clients or those handling increased rates. In the 2022 J.D (accident). Power Client Satisfaction Rating for large insurers, GEICO placed behind Freedom Mutual, State Farm, as well as Allstate and also in advance of Farmers, Travelers, and also Progressive, with a score of 869 out of 1,000.

The process of damages evaluation, temporary auto rentals, and repairs for those that submitted a case can be finished at a GEICO Vehicle Repair Xpress facility after the cases procedure - cheap insurance. Price quotes can be compared in other places.

8.8 The details, The excellent, Offered in all 50 states. Some significant automobile insurance provider don't compose policies in every state, however that's not the instance with GEICO, which is offered regardless of where in the united state you live. Easy-to-use digital devices GEICO's website as well as mobile application are straightforward and also easy to accessibility.

How Can I Renew My Geico Car Insurance Policy? - Jerry - The Facts

9. 7GEICO, which means Government Employees Insurance provider, started in 1936 as an insurance service provider for federal workers, yet expanded to the general populace in the '70s. Currently, GEICO is a major auto insurer, with more than 17 million automobile plans in pressure. Alongside GEICO's history, multiple economic companies are certain that GEICO will be around for a while.

Primarily, there's little possibility GEICO will go broke quickly. 7. cars.2 For the many component, clients are satisfied with GEICO. Covers the price if you're in a mishap created by a motorist without insurance policy, or whose insurance does not cover the complete level of the damage.

Greet to Jerry, your brand-new insurance representative (laws). We'll contact your insurance policy firm, examine your current strategy, then locate the coverage that fits your needs as well as conserves you cash.

For full coverage with GEICO, the ordinary cost is $1,325. Based on those numbers, vehicle drivers that select GEICO conserve a standard of $200 for minimal protection as well as a standard of $413 for complete protection.

For that person, it would certainly cost around $18 a month for three decades of term life insurance policy, $12 for 20 years, and $9 for ten years. cheapest car. GEICO Life Insurance policy Discounts Life insurance policy price cuts with GEICO might differ extensively since it has companions who sell as well as underwrite life insurance policy policies for it.

Indicators on 2022 Best Cheap Car Insurance In Oklahoma - The Motley Fool You Should Know

"According to client review information, GEICO is simply slightly behind market standards," says Alice Stevens, an insurance policy professional and also senior editor at Finest Company. GEICO's grievance index rating with the National Association of Insurance coverage Commissioners suggests above typical issues. GEICO has the most effective A.M. Best rating that's possible to attain: A++ - car.

If you wish to sue with certain plans (i. e. life, homeowners), you need to speak to the business that underwrites them as well as not GEICO directly, which can be a frustration for insurance holders, No gap insurance policy coverage, Various other Plans Supplied by GEICOPeople wanting to maintain all their insurance plan with the very same company will certainly be pleased to know that GEICO uses several kinds of insurance policy, plus discount rates for bundling.

Often Asked Inquiries Is GEICO a great insurance coverage company? On the whole, GEICO is a good insurance policy business.

Why is GEICO so affordable? The most obvious attraction to GEICO is the rates. By supplying the solutions only directly to the clients as well as using discounts on numerous plans, GEICO can provide considerable price cuts over competitors. Who does GEICO make good sense for? Due to the fact that of discounts, easy to use app, and reduced rates, GEICO mainly accommodates people trying to find convenience and value - credit score.

pros, This is a symbol, Inexpensive policies for all Visit the website kinds of drivers, This is a symbol, Uses lots of discounts consisting of some one-of-a-kind optionscons, This is an icon, Does not use insurance coverage for new cars and truck substitute or much better car substitute, This is an icon, Average issue resolution scores, GEICO has exceptional ratings when it concerns price, security as well as price cuts and also has an above-average ranking for individual fulfillment.

GEICO Automobile Insurance Policy Quotes: How Much Does it Expense? Money, Geek's evaluation involved celebration quotes from GEICO throughout 50 states to compute the insurance firm's average rates.

The 8-Minute Rule for Geico Vs. Progressive: Which Is Better For You? - Marketwatch

cheap car insurance cheaper auto insurance cheaper car auto insurance

cheap car insurance cheaper auto insurance cheaper car auto insurance

Price Cuts Used by GEICO That Can Assist You Conserve, Although GEICO has inexpensive insurance for motorists from different backgrounds, you can lower insurance policy prices better by using the several discount rate opportunities the company offers its insurance holders. GEICO supplies discounts for mounting an and in your vehicle, for or guaranteeing with GEICO and also for drivers with a history of.

credit score credit score money dui

credit score credit score money dui

You can likewise make use of several of the more unusual discounts that GEICO gives by constantly, setting up and also having. GEICO also provides discount rates for, and also motorists on. Compare GEICO Straight With Other Car Insurance Coverage Companies, Cash, Geek's resources will certainly aid you discover the very best car insurance coverage business for your distinct circumstances by contrasting GEICO policies to those of other insurance companies in your state.

https://www.youtube.com/embed/vMifnPMlP9Q

GEICO does not offer or insurance coverage that other leading insurance coverage companies generally supply. An unique coverage that GEICO supplies is insurance that gives better coverage at a lower cost than the regular dealer-extended service warranty. It consists of all parts as well as systems as well as is offered for brand-new or rented automobiles that are less than 15 months old as well as have much less than 15,000 miles on them.

4 Easy Facts About Why You Need Rideshare Insurance And Which Companies ... Shown

Edit your About page from the Pages tab by clicking the edit button.

The 6-Second Trick For Premium Uber & Lyft Driver Insurance In Chicago, Il

Edit your About page from the Pages tab by clicking the edit button.

Best Rideshare Insurance 2022 - The Balance - The Facts

Edit your About page from the Pages tab by clicking the edit button.

Some Known Details About Why You Need Rideshare Insurance And Which Companies ...

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of Driver Rideshare Insurance - Gap Coverage For Lyft, Uber, More That Nobody is Dis

Edit your About page from the Pages tab by clicking the edit button.

Not known Details About Car Insurance For Uber And Lyft Drivers

Edit your About page from the Pages tab by clicking the edit button.

Ford Capri: All Models (Except Rs) 1969 To 1987 Things To Know Before You Get This

Speak with Your Agent It is essential to note that there might be various other expense financial savings to be had in addition to the ones explained in this write-up. That's why it usually makes sense to ask if there are any kind of special price cuts the firm offers, such as for army personnel or workers of a specific company (suvs).

Nevertheless, there are numerous points you can do to minimize the sting. These 15 suggestions need to get you driving in the right instructions. Keep in mind additionally to contrast the best vehicle insurer to find the one that fits your coverage needs and also budget.

The cash we make helps us give you accessibility to free credit rating and records and also assists us create our other fantastic tools and academic materials (cheapest). Payment may factor right into exactly how and where items appear on our system (and in what order). Considering that we typically make money when you discover a deal you like and obtain, we attempt to show you uses we think are an excellent suit for you.

cheap auto insurance risks insure low cost auto

Among the simplest methods to go shopping about for insurance coverage is to compare car insurers online - accident. If you prefer to evaluate insurance alternatives with a person, dealing with an auto insurance coverage representative is another method to go. It's not simply your driving record that identifies the insurance coverage quotes you get.

They use cases data as well as personal information, among other website factors, to examine this risk. In some states, your credit rating can have some impact on your premium (though The golden state, Massachusetts as well as Hawaii have all banned the technique of using credit-based insurance scores to aid figure out rates) - cheap car.

Some Known Details About N1c96

For example, a 2015 Consumer Reports survey shows that single participants with simply "good" debt paid as a lot as a massive $526 even more a year (depending on their state) than comparable motorists with the best credit history. In enhancement to credit score, your insurance policy rates may also be impacted by the list below elements: Certain locations have higher-than-normal prices of mishaps and vehicle burglary - affordable.

The more pricey your auto is, the higher your insurance coverage prices may be (auto). Insurance firms can likewise take a look at whether chauffeurs with the exact same make as well as version tend to file even more insurance claims or be in even more accidents, in addition to security test results, price of repairs and burglary price (vehicle). Placing fewer miles on your car every month can affect the prices you get.

Information shows that the likelihood of a mishap may be connected to these elements. Responsibility insurance coverage normally contains 3 kinds of protection: physical injury responsibility coverage, home damage responsibility insurance coverage and also uninsured motorist coverage. Each state that needs responsibility insurance coverage has its very own minimum protection requirement, but you can select much more insurance coverage at a cost - dui. They could all be at danger if you create an accident that results in clinical or building damages costs that surpass your insurance coverage limitation. You might want to pick protection limitations that, at minimum, reflect the worth of your combined possessions.

laws cheapest car insurance credit score insure

laws cheapest car insurance credit score insure

He delights in providing viewers with information that can make their lives better and also a lot more expansive. Warren holds a Bac Read more. Find out more.

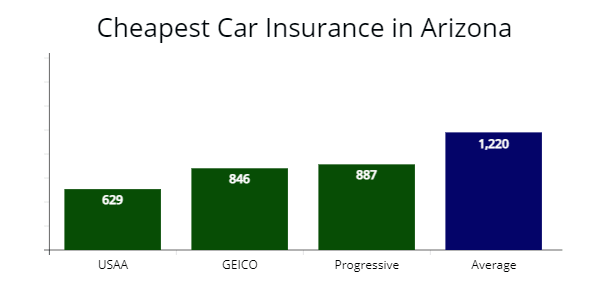

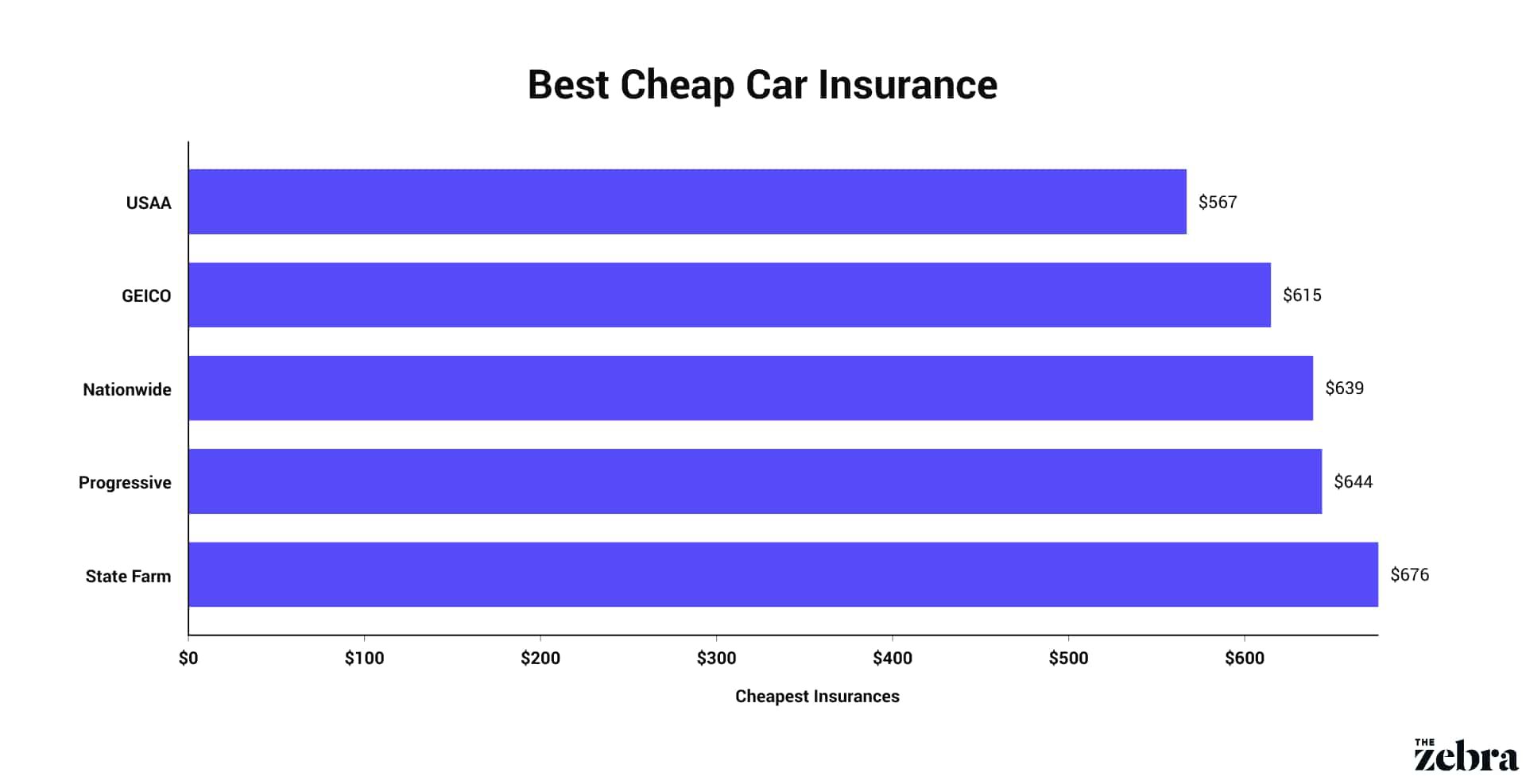

Below are extensive reviews of our leading referrals for the least expensive vehicle insurance provider based upon ordinary rate quotes (vehicle insurance). The adhering to service providers stand out from the competitors as the most effective inexpensive car insurance coverage providers not just for the discount rates they supply however likewise for their customer care and also strong sector online reputations (suvs).

9 Easy Facts About The Cheapest Car Insurance Companies & Quotes (May 2022) Described

auto auto car insurance cheaper auto insurance

auto auto car insurance cheaper auto insurance

In addition to having budget-friendly plans, USAA is just one of one of the most trustworthy providers in the sector and earns some of the highest possible customer fulfillment rankings. Below are a few various other points we like regarding USAA: Choices for mishap mercy, ensured property defense (space insurance policy), car replacement assistance (CRA) and usage-based insurance coverage # 2 Erie Insurance Coverage: Budget Friendly for Fundamental Coverage Our evaluation shows Erie Insurance coverage is one of the most inexpensive insurance suppliers for several types of chauffeurs.

The Erie Price Lock program permits eligible customers to avoid the costs increases that occur over the course of a couple of years - cheap car insurance. In this program, there are just 3 reasons that insurance holders can see their prices enhance: including or removing a car, including or eliminating a person from the policy or altering addresses - cheaper.

cheap car insurance affordable money vans

If you fit this summary, automobile insurance coverage from Erie can usually be extremely cost effective. At that range, State Ranch can supply an array of insurance coverage degrees to satisfy most motorists. The firm offers rideshare coverage, roadside aid, accident mercy and also more.

https://www.youtube.com/embed/ph7eyV-1RIk

Geico's remarkable price cuts consist of 25% savings for insuring multiple automobiles and also a 15% student discount. Right here are a few more things we like regarding Geico: A++ economic strength rating from AM Finest 3rd location for New England as well as fourth location for California in the J - vehicle insurance.D - insured car. Power Vehicle Insurance Coverage Research study 78% customer fulfillment rate amongst its insurance holders in our 2022 vehicle insurance policy survey Alternatives for mechanical failure insurance and also usage-based insurance Highly rated mobile application # 5 Progressive: Budget-friendly for High-Risk Drivers As the country's third-largest car insurer, Progressive covers countless automobiles per year and can be among one of the most budget friendly selections for coverage.

An Unbiased View of Rental Car Insurance: What Types Do I Need? - Rentingcarz

SLP, including UM/UIM advantages is given just when Occupant or any kind of AAD are driving the Lorry. No insurance claim for UM/UIM might be made due to the oversight of the driver of the Vehicle. SLP COVERAGE IS IN IMPACT ONLY WHILE ANOTHER AAD OR TENANT IS DRIVING THE LORRY WITHIN THE UNITED STATES AND CANADA; PROTECTION DOES NOT APPLY IN MEXICO. suvs.

Benefits are payable in addition to any type of other insurance policy coverage the occupant or travelers may have. This is a summary only - automobile. PAI/PEC undergoes the stipulations, constraints and exclusions of the PAI/PEC policy underwritten by Empire Fire and Marine Insurer in the United States or AIG Insurance Coverage of Canada. vans.

The protection supplied by PAI/PEC might replicate the occupant's existing coverage (insurers). Alamo is not certified to assess the competence of the renter's existing protection; therefore, the renter should analyze his/her individual insurance coverage or various other sources of coverage that might replicate the coverage given by PAI/PEC. - Tenant may buy Roadside Plus (RSP) from Proprietor for an added cost.

Cost of a substitute tire is not covered by RSP), lockout service (if the secrets are locked inside the vehicle), jumpstarts, and fuel delivery solution for as much as 3 gallons (or equivalent litres) of fuel if Automobile is out of gas. Roadside And also solutions are only readily available in the United States and Canada.

Are You Covered Under an Existing Auto Insurance Plan? If so, does this car insurance cover damage to or your usage or procedure of a rental vehicle? Get in touch with your representative and also identify what kinds of protection your policy(s)offers you when renting a vehicle (cheapest). Make certain to ask especially concerning responsibility, thorough and also crash protection - car insured.

What Does Rental Car Insurance Do?

It's ideal to call and also find out all the details of your coverage like the quantity of your deductible and also any various other significant informationbefore choosing up your service. automobile. Inspect to see what your credit card covers when renting out an auto.

credit cheaper cars insurance company suvs

credit cheaper cars insurance company suvs

cheap vehicle insurance car insured automobile

cheap vehicle insurance car insured automobile

Should I purchase the extra insurance policy when I rent an automobile? Before you are encountered with the concern of whether or not you need to pay for the added insurance coverage when you are renting an automobile, right here are a few fast notes: If you carry your Car Insurance plan, those usually (as long as they are within the United States).

Even if your Auto policy extends to the rental automobile, there that emerge in the event of a crash. Allow's think you had a fender bender that created $5000 in damage to the car. Along with that damages (that would ideally be covered by your personal Vehicle Insurance coverage), the rental automobile company will certainly analyze added costs since they can no longer lease that automobile until it is repaired, plus any type of management and also handling costs they credit collaborate and handle the solutions and losses.

So, what are your options? You generally have 3 major choices when leasing a cars and truck: that supplies specific advantages for rental automobile situations. Most of the feature-rich cards supply special coverage for these circumstances, making the rental cars and truck offering much less needed If you don't have among these debt cards, you can just, however feel in one's bones that you might quickly have the extra fees stated over if you did have a broken automobile while renting it (low cost).

Hopefully this aids you feel much more comfy with the protection situation as well as choices the following time you're asked the concern of whether to acquire the additional protection when renting out a car (liability).

Facts About Should I Get Insurance Rental Car? Neverstoptraveling Uncovered

Lots of individuals enjoy "destination" vacations where they fly to the area after that rent a vehicle for neighborhood transport. When you lease a car, it is very important to have the best insurance policy protection for the rental. Should you take the protection offered by the rental company? Or will coverage offered by your personal car insurance plan as well as the credit card utilized to lease the vehicle suffice? Locating the very best insurance policy protection for the vehicle you rent relies on the solution to a number of important concerns.

In other situations, the coverage supplied by the rental agency might be your ideal selection, even though it may cost more. Prior to you book a rental automobile (as well as absolutely before you hit the rental counter), doing some initial research study will certainly aid you select the coverage that's ideal for you (cheap car insurance).

car insurance auto insure auto

car insurance auto insure auto

We'll have some ideas regarding insurance coverage for auto services abroad at the end of the write-up. Generally, you desire the same insurance policy coverage for risks on a rental vehicle that you would certainly carry a late version cars and truck you have. Such protection generally consists of: Damages to or loss of the automobile, such as that created if the automobile is in a collision, is taken or is harmed in a non-wreck event such as a dropped tree arm or leg, hailstorm, flooding, or fire - money.

The very first 3 kinds of coverage are really vital when you rent a cars and truck; the 4th kind of insurance coverage for loss of personal building is optional. The very best option for lots of people will be the primary protection offered by their individual auto insurance coverage, backed up by the second coverage provided by the bank card utilized to lease the automobile - cheapest auto insurance.

Utilize the concerns given in the following two areas. If you intend to buy travel insurance coverage to cover your trip, check to see if the plan gives insurance for rental autos. Lots of do give such insurance coverage. The last option is making use of the coverage supplied by the auto rental firm. Taking this insurance coverage may be the "easiest" due to the fact that you can register when booking an appointment or at the counter, however it is almost always the most costly (trucks).

Not known Facts About Should I Get Insurance Rental Car? Neverstoptraveling

insurance affordable auto insurance insurance companies insured car

insurance affordable auto insurance insurance companies insured car

If your policy pays only "book value," ask concerning the expense of "space" insurance policy that would certainly cover a new cars and truck replacement for a completed vehicle. Does the plan cover all sorts of rental cars, such as trucks, SUVs and pricey, "exotic" automobiles? Some policies might limit the kind of rental car covered.

"Additional" protection means that the charge card business covers specific losses (approximately its limits) that remain after your personal vehicle insurance has paid the losses it covers up to its limitations. To get a details charge card's protection you have to make use of that card to book and spend for the rental.

Due to the fact that insurance coverage given might vary extensively in between cards, call the customer care number on each of your cards and ask the following inquiries. After that contrast insurance coverage amongst your charge card and also rent out the vehicle making use of the card with the very best insurance coverage. Does the card deal secondary insurance coverage of rental cars and truck insurance policy? What sorts of loss does it cover? What are the restrictions of protection? Does the card's insurance coverage have any type of exemptions? As an example, some don't cover damages to tires, edges, or outdoors mirrors.

The loss damage waiver (LDW) uses one of the most protection as well as generally increases the cost of the service by 30%. business insurance. The in fact everyday charge for this coverage, nonetheless, can differ commonly. This security is not really insurance coverage, yet a waiver by the insurance provider that says that you as renter will not have the monetary responsibility if the rental automobile is harmed or swiped.

Make certain that all drivers of the vehicle are on the rental contract (you might have to pay extra) due to the fact that insurance coverage will be void if any kind of event happens when an unapproved motorist is running the lorry. dui. Generally states need basic responsibility coverage on leasings, yet the requirements differ. Be certain to inspect the limits and also regards to this protection prior to buying.

The smart Trick of Rental Car Insurance - State Farm® That Nobody is Discussing

is a bit different. Lots of personal automobile insurance plan and charge card do not extend coverage to leasings you make in Europe, Central America and other areas of the globe. Nevertheless, some insurer as well as credit cards will certainly prolong insurance coverage for a restricted time to other nations for an extra fee (credit score).

Travel insurance policy for a journey abroad frequently contains insurance coverage for a rental vehicle. If you are buying travel insurance policy, check for such insurance coverage and also its limitations and terms.

https://www.youtube.com/embed/Q_4ofo77UP8

If you select this alternative, purchase it when you are making the bookings and assess the terms of the protection. Putting in the time to Click for more info understand and arrange for adequate insurance coverage for a rental cars and truck can offer you peace of mind as you head out for a restful vacation. It can also save you moneydollars that might enable you to enjoy a couple of extra deals with vacationing.

Little Known Facts About How Much Will You Spend In Your Lifetime On Car Insurance?.

The majority of yet not all states permit insurance provider to use credit history when setting rates. In general, applicants with reduced ratings are more probable to sue, so they normally pay much more for insurance coverage than vehicle drivers with higher credit history. If your driving record consists of accidents, speeding tickets, Drunk drivings, or various other violations, anticipate to pay a higher premium.

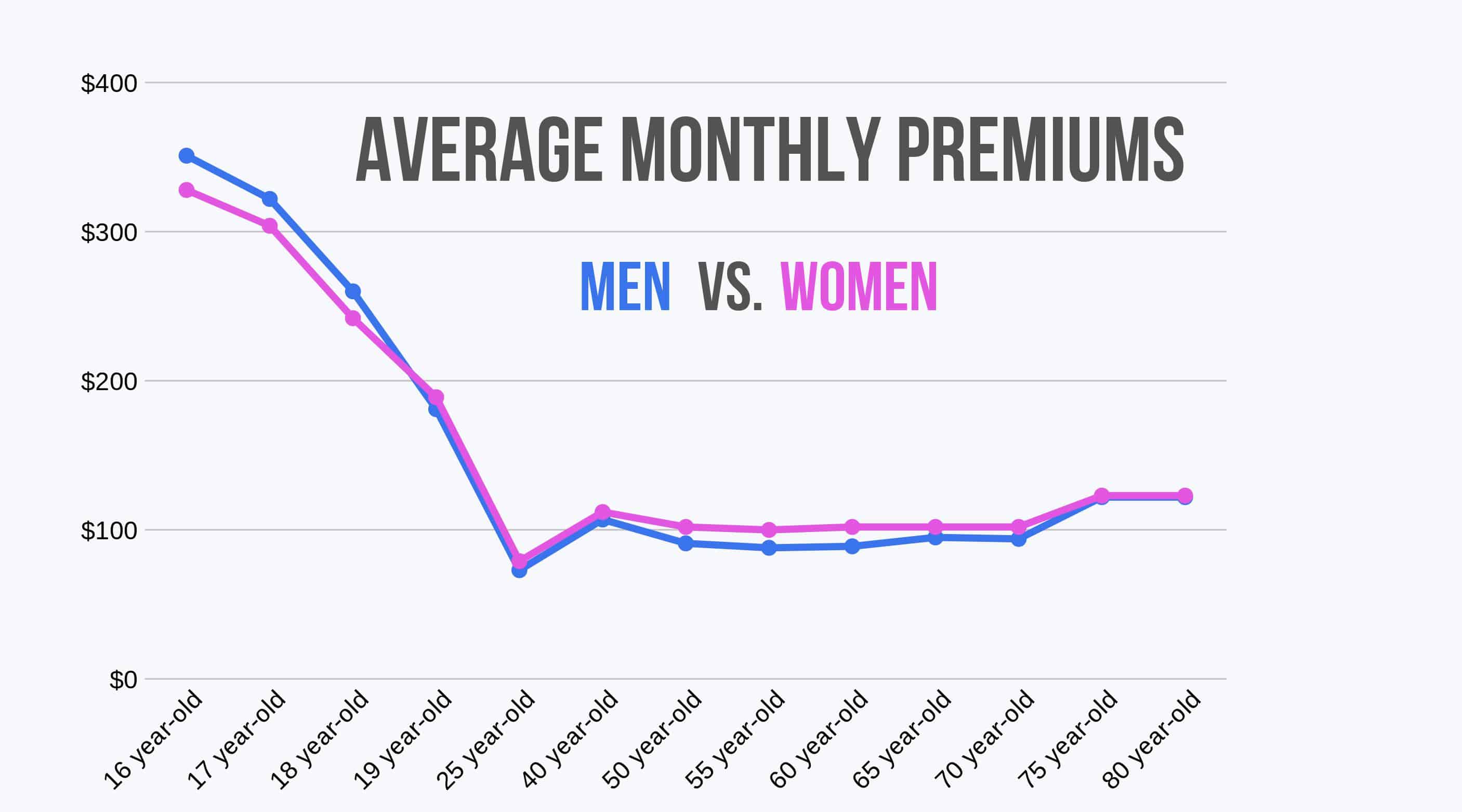

Cars with higher cost generally cost more to guarantee. Vehicle drivers under the age of 25 pay greater rates as a result of their absence of experience and also boosted accident risk. Men under the age of 25 are typically priced estimate higher rates than females of the same age. Yet the space shrinks as they age, and also females might pay a little much more as they age.

Since insurance coverage firms have a tendency to pay more cases in risky locations, prices are generally higher. Getting appropriate protection may not be affordable, however there are means to obtain a price cut on your cars and truck insurance coverage.

If you possess your home as opposed to renting it, some insurance firms will certainly provide you a discount rate on your auto insurance coverage premium, even if your home is insured through one more company. Aside From New Hampshire and Virginia, every state in the nation requires chauffeurs to keep a minimum quantity of obligation protection to drive legally.

It may be alluring to stick to the minimal limitations your state calls for to save on your premium, however you can be putting yourself at danger. State minimums are notoriously low and also could leave you without adequate defense if you're in a severe accident. The majority of specialists advise keeping sufficient coverage to safeguard your possessions (vans).

The smart Trick of Average Cost Of Car Insurance In May 2022 - Bankrate That Nobody is Talking About

When you're in the market for vehicle insurance, you might have a number of inquiries as you do your research study and also review your personal spending plan. Among your biggest concerns may be how Click here to find out more much does vehicle insurance price? The solution will certainly rely on a number of variables. It's handy to understand that there are several variables that factor right into the expense of a vehicle insurance plan.

Why Do You Want Vehicle Insurance Coverage? The easy response is that in many states, some auto insurance is required and also it can assist shield you from having to pay the expenses connected with a crash or incident, specifically if you harm somebody else. Even a small mishap can set you back hundreds of dollars, specifically if it leads to residential or commercial property damage as well as bodily injuries - insurance.

Cars and truck insurance coverage assists provide a chauffeur defense from the costs linked with an automobile mishap. Depending on the vehicle insurance policy coverage you pick to acquire, insurance coverage can consist of the price to repair your car, the repair work of the various other motorist's cars and truck, any type of resulting clinical expenditures as well as even lost wages if injuries cause missed time from job - business insurance.

Minimum protection demands might vary, so a savvy approach may be to review your insurance coverage choices to aid ensure you're appropriately secured. What Protection Do You Want? Automobile insurance coverage that offers the most defense will normally include the best price, yet additionally with one of the most financial protection (cheapest).

What securities will best meet your requirements?: If you have created a mishap and also are responsible for the problems to others, this insurance coverage may pay up to the limitation you choose - cars.

3 Easy Facts About Auto Insurance Climbing 5% In 2022. Where It's Most, Least ... Explained

: Accident insurance coverage can help pay for damages to your car if you are in a crash with an additional automobile or things, or if your car rolls over. This protection is usually required if you're renting or financing your vehicle.

This protection will likely be called for if you have a financing on your cars and truck or lease it. Medical Settlements Insurance Coverage (Med, Pay): Medical Repayments Insurance coverage commonly covers medical expenditures for the therapy of injuries to you and your travelers caused by an auto crash. It compensates to your Medication, Pay policy restriction despite that is at fault.

The Kind of Auto You Drive A higher-end automobile will normally set you back even more to insure, largely due to the fact that of the greater price that commonly accompanies a fixing or replacement. Where You Live and Park Your Cars and truck Car insurance policy rates differ from state to state. Your rates can be greater or lower relying on where you live (vehicle).

If you've recently added a young motorist to your policy, know that they are expensive to guarantee considering that they have much less experience. Your Driving Background If you've been entailed in mishaps over the last few years, it's most likely that your premium will be greater than a person that hasn't had any kind of mishaps.

An efficient way to reduce your insurance policy costs is to capitalize on discounts your insurer supplies. Points like packing your vehicle, house and other policies might minimize your costs (affordable car insurance). There are various other price cuts that could aid to lower your costs such as discount rates for paying your premium digitally or by pay-roll reduction, preserving a safe driving record, having continuous insurance coverage with the same service provider and also a great pupil discount.

Excitement About Average Car Insurance Cost (May 2022) - Wallethub

More Prepare & Prevent Picking car insurance is a challenging task provided the wealth of service providers and coverage choices. There are many factors to take into consideration when including an additional vehicle to your automobile insurance coverage. It's appealing to buy a new cars and truck that looks fantastic and also is enjoyable to drive, however you must also think about security and also insurance policy prices (cheaper car).

Right here are 10 methods to reduce your car insurance coverage. Relevant Products & Discounts This covers non-collision relevant damage to your car, such as burglary, fire or influence with an animal. Bodily injury and property damage responsibility insurance coverage gives compensation for injuries to others, your legal expenditures as well as damages to others' property if you cause a crash - automobile.

Exactly how much vehicle insurance coverage do you require? The response depends on a variety of aspects, including where you live, how much your vehicle deserves, and what various other assets you require to safeguard. Here's what you need to understand. Trick Takeaways The majority of states need you to have at least a minimal amount of insurance coverage for any injuries or property damage you create in a crash.

Comprehensive coverage, additionally optional, shields against other threats, such as theft or fire. Uninsured vehicle driver coverage, obligatory in some states, secures you if you're hit by a chauffeur that doesn't have insurance. business insurance. How Automobile Insurance coverage Works A car insurance plan is really a bundle of numerous various types of insurance policy.

For instance, if you possess your home or have a substantial quantity of money in savings, an expensive accident might put them at threat. Because case, you'll wish to buy even more coverage. The not-for-profit Customers' Checkbook, to name a few, advises buying protection of at the very least 100/300/50, just in case. The difference in cost between that insurance coverage and your state's minimum will most likely not be quite.

Rumored Buzz on How Much Does Car Insurance Cost By State? - Progressive

It's stood for on your policy as the 3rd number because sequence, so a 25/50/20 policy would provide $20,000 in insurance coverage. Some states need you to have just $10,000 or perhaps $5,000 in residential or commercial property damage liability coverage, yet $20,000 or $25,000 minimums are most usual. Once more, you might intend to purchase even more insurance coverage than your state's minimum - low cost auto.

A commonly recommended degree of residential property damage coverage is $50,000 or even more if you have substantial possessions to protect. Clinical Payments (Med, Pay) or Accident Protection (PIP) Unlike physical injury responsibility insurance coverage, clinical settlements (Med, Pay) or injury defense (PIP) covers the cost of injuries to the vehicle driver and also any travelers in your automobile.

insurers insurance company car insurance cheap auto insurance

insurers insurance company car insurance cheap auto insurance

Whether medical payments or PIP coverage is mandatory, optional, or also offered will depend on your state. In Florida, for example, motorists should carry at least $10,000.

If you do not have health and wellness insurance policy, nevertheless, you could want to purchase more. Crash Protection Accident coverage will certainly pay to repair or change your auto if you're entailed in a mishap with another auto or strike some other item.

If you have an auto car loan or are leasing the auto, your lending institution may require it. When you've paid off your lending or returned your rented vehicle, you can go down the coverage.

The Single Strategy To Use For What Is The Average Cost Of Car Insurance? - Money Helper

car insured cheap car insurance auto low-cost auto insurance

car insured cheap car insurance auto low-cost auto insurance

The price of collision coverage is based on the value of your auto, as well as it generally includes a insurance deductible of $250 to $1,000. If your auto would set you back $20,000 to replace, you would certainly pay the first $250 to $1,000, depending on the deductible you selected when you got your plan, as well as the insurance provider would certainly be liable for as much as $19,000 to $19,750 after that.

Between the cost of your annual costs and the deductible you 'd need to pay out of pocket after a mishap, you can be paying a lot for extremely little insurance coverage. Even insurance provider will tell you that dropping crash insurance coverage makes feeling when your cars and truck deserves less than a couple of thousand dollars - auto insurance.

It additionally covers car burglary (perks). And also once more, when you have actually paid off your financing or returned your rented car, you can drop the insurance coverage.

cheap car insurance insured car perks laws

cheap car insurance insured car perks laws

You'll also desire to consider how much your automobile is worth compared with the expense of covering it year after year. Uninsured/Underinsured Vehicle Driver Insurance coverage Just due to the fact that state regulations call for drivers to have liability insurance coverage, that doesn't suggest every driver does.

That is where this kind of insurance coverage can be found in. It can cover you and also relative if you're harmed or your automobile is harmed by a without insurance, underinsured, or hit-and-run vehicle driver. Some states call for motorists to lug without insurance motorist insurance coverage (UM). Some additionally call for underinsured motorist protection (UIM). Maryland, for instance, needs chauffeurs to bring uninsured/underinsured driver physical injury liability insurance policy of a minimum of $30,000 each and $60,000 per mishap.

Some Known Factual Statements About How To Estimate Auto Insurance

If your state calls for uninsured/underinsured motorist protection, you can buy even more than the called for quantity if you wish to. cheap car insurance. You can also purchase this coverage in some states that do not need it. If you aren't called for to get uninsured/underinsured vehicle driver coverage, you could wish to consider it if the coverage you already have would certainly want to foot the bill if you're involved in a significant accident.

Other Kinds of Coverage When you're looking for vehicle insurance policy, you might see a few other, totally optional sorts of insurance coverage (auto insurance). Those can consist of:, such as towing, if you need to rent out a car while yours is being fixed, which covers any type of difference between your automobile's cash money value as well as what you still owe on a lease or loan if your car is a complete loss Whether you need any of those will depend on what various other sources you have (such as membership in a car club) and also how much you might manage to pay of pocket if you must.

https://www.youtube.com/embed/5lG7RKbPbq8

Whether to get even more than the minimum required insurance coverage as well as which optional kinds of protection to think about will depend upon the assets you need to shield along with just how much you can pay for to pay. Your state's automobile division website must discuss its demands as well as might use other suggestions specific to your state.

California Car Insurance Laws, Rules And Requirements Things To Know Before You Buy

We have compiled a listing of the most awful residential property coverage companies in Texas, with the aid of examining great deals of information concerning these groups containing court room files, truths, and also interviews from insurance policy personnel (cheaper car). If you have actually had residential property damage, as well as your insurance coverage carrier is not properly paying your claim, you need to recognize that they may be now not to your side.

suvs perks cheapest auto insurance suvs

suvs perks cheapest auto insurance suvs

ensure what is universal life insurance coverage vs. entire life what is ga vs - laws. wholesale in the insurance coverage industry just how to sue with farmers why is farmers insurance calling me do farmers insurance policy include medpay automobile insurance policy.

When you try to make a case on your insurance coverage, you may locate that your insurer rejects your case or does not pay the sum total you are asking for. This web page informs you why an insurance company might determine to do this - affordable auto insurance. Your insurance provider may decline to pay your claim since: the policy was not effective when what you're asserting for occurred the plan is void because you didn't tell the fact when you obtained insurance policy or failed to reveal something which could affect your case (for plans taken out, restored or changed) the policy is invalid due to the fact that you purposely or thoughtlessly held back info or misled your insurance companies (for policies gotten, restored or altered) the item is not covered by your policy there is an exemption provision in the policy which indicates that you can't claim wherefore's occurred you have actually missed several of the instalments of your costs you didn't inform your insurance provider concerning an adjustment in your situations you have not adhered to the claims process appropriately you haven't maintained to a problem of your plan you have actually overemphasized the claim and are attempting to declare for more than you should.

Without insurance losses and also your excess In some cases an insurance claim will certainly not be covered by your policy. A power cut might imply that your freezer materials have to be thrown away yet your policy might not cover the cost of replacing them.

An excess is the fixed amount of any claim, for instance the initial 50, that you have to pay on your own. If you shed out economically as well as you're not insured yet what's occurred is not your mistake, you might be able to take the individual or company who triggered your loss to court to recuperate your expenditures. affordable car insurance.

The 9-Second Trick For Faqs Regarding Repairs To Your Vehicle - Ct.gov

If you have problem obtaining your cash back, you can take the insurer or motorist to court. If your insurance coverage business have actually taken care of the case, they must assert the excess back for you. If you have a no mistake crash, a credit score hire firm can likewise make a claim on your part.

This may be since: you have under-estimated the total value of your case as well as do not have sufficient insurance coverage to cover your losses. This is called being your insurer thinks that you have actually put an impractical value on your insurance claim, and will just pay you part of it unless you have a policy, the item for which you are declaring was old, and also your insurer will pay you much less than the cost of changing it with a brand-new thing.

If you believe your insurance company is acting unreasonably in refusing to pay the sum total of your claim you ought to try to discuss with them to get to a contract (cheaper). If you're not pleased with what your insurance firm supplies, you can grumble using your insurance companies grievances procedure.

This cash, if granted by a court or jury, will need to come from someplace else. There are a variety of manner ins which a hurt person may gather compenastion in unwanted of insurance coverage limitations. These approaches include: bringing a individual injury lawsuit against more than one offender recovering under an umbrella insurance plan, and also attempting to collect from an accused personally.

Taking Legal Action Against Extra Offenders In Some Cases, even more than one celebration can be held legitimately and also financially responsible for a mishap. In many such situations, the different defendants might be said to be "collectively and also severally" accountable for the entire amount of problems. This would imply that if there were 2 offenders and also each had a policy limitation of $50,000, both of those offender's policies might likely be made use of to please a $100,000 judgment.

How Can An Insurance Company Pay Less Than I Owe In A Car ... can Save You Time, Stress, and Money.

Some instances of situations where there could be several accuseds include: Medical malpractice: There might be multiple offenders if both a hospital and also a physician fully commited medical negligence when supplying like a client. Product liability: The producer of a defective item can typically be filed a claim against, and also an instance could be feasible against the supplier or perhaps the store that offered the item.

cheaper car insurance cheaper auto insurance vehicle cheap

cheaper car insurance cheaper auto insurance vehicle cheap

The concept right here is that the employer presumes legal obligation for the employee's carelessness. Umbrella Plans In specific instances, also if there is a solitary offender, there might be numerous insurance coverage policies in play. Some accuseds, specifically corporate entities and also large organizations, might have an umbrella plan that basically "looks at" every one of the various other insurance policy coverage they have - vehicle insurance.

> What if the Other Motorist Doesn't Have Insurance Coverage? If so, obtaining payment might be a lot more challenging than you assume. The experienced Atlanta automobile mishap legal representatives at Hasner Law Computer are right here to help.

It might be the situation that the at-fault driver has a plan Check out this site that conforms with the minimal coverage restrictions, but this might not be enough to totally compensate you for your injuries (suvs). Or, a motorist might be in charge of a crash and after that flee the scene. Instances of insufficient coverage and also those with hit-and-runs chauffeurs can be especially intricate, so it's best to connect to an injury lawyer if you are involved in either of these kinds of mishaps.

The I Totaled My Car And Still Owe Money On The Loan. What Now? Statements

vehicle insurance cheap car insurance insurers suvs

vehicle insurance cheap car insurance insurers suvs

In limited cases, you may likewise be able to get what are called compensatory damages. These require the other chauffeur to have behaved in some negligent way, such as driving drunk. Remember that these are not a common award and also need significant evidence of wrongdoing. The damages can get fairly big and would certainly be above and also beyond your common settlement.

Commonly vehicle drivers that do not carry insurance policy have couple of properties - insure. Hit-and-run situations can likewise supply a number of difficulties for damaged chauffeurs.

Just How Without Insurance as well as Underinsured Motorist Protection Can Assist In order to much better protect on your own, you might consider enlisting in without insurance motorist coverage () or underinsured motorist coverage (UIM). Keep in mind that this is optional and also not called for by legislation. cars. Additionally, bear in mind that you have to have this insurance policy in position prior to the mishap occurs in order to be covered.

Especially, they cover: Drivers without cars and truck insurance coverage, Chauffeurs with insurance policy yet not adequate to cover problems, Hit and also run motorists that can't be recognized, or, Unidentified, uninsured, or underinsured drivers that wound you while you are walking or cycling. cheap insurance. Now, there are 2 types of UM/UIM insurance coverage that you might have, standard and also add-on.

As an example, let's claim that you have $100,000 in insurance coverage as well as the various other vehicle driver has a $50,000 at-fault limit. If the chauffeur creates a mishap that leaves you with $200,000 in problems, you would only be qualified to $100,000 under this plan. Right here, $50,000 would be based on the various other driver's plan and $50,000 would originate from your very own uninsured coverage.

How Colorado Uninsured Motorist Coverage Laws - Bachus ... can Save You Time, Stress, and Money.

Yet, with add-on coverage, your plan will certainly pay approximately its optimum no matter the various other motorist's limitations. Utilizing the same instance from above, you would obtain $50,000 based upon at-fault protection from the other driver, plus $100,000 from your own uninsured plan limitation. This would total $150,000 and also you would be entrusted $50,000 to handle out-of-pocket.

Therefore, you may consider connecting to a skilled car mishap attorney in Atlanta if you have concerns regarding the extent of your insurance coverage for these kinds of accidents. car insurance. Collision and Medical Payments Insurance coverage An additional choice that can assist in these cases is crash insurance coverage. Like uninsured/underinsured coverage, collision is optional.

This is often referred to as individual insurance coverage defense (PIP) as well as is a type of optional insurance coverage that can pay for things like clinical expenses and funeral service expenditures following a crash. It offers insurance coverage to both motorists and also passengers as well as acts comparable to health insurance policy.

Difficulties With Without Insurance Vehicle Driver Claims While having several of these plan choices in location may provide you peace of mind, you can come across troubles with your insurance business after a mishap. This is due to the fact that insurance companies rarely prioritize the interests of their insurance policy holders. Rather, they aspire to settle the insurance claim as swiftly as well as inexpensively as feasible.

cheapest auto insurance auto low-cost auto insurance credit

cheapest auto insurance auto low-cost auto insurance credit

We will totally examine your claim as well as establish that must as well as can be held financially liable for your injuries. If needed, we will certainly submit match against the responsible party straight as well as take actions to make sure that you accumulate on any kind of judgment quantity that is owed to you (insure). It is very important to not feel forced to clear up these issues too rapidly.

Fascination About Totaled Vehicle : After An Accident

In instances where an insurance business does not take your insurance claim seriously, we will manage this procedure for you. Do not postpone you just have a minimal amount of time in which to submit a case.

The timeframe is two-years for injuries as well as four-years for building damages. Failing to file by the target date can result in you losing your right to insurance protection - insure. Even if you are not in danger of missing out on the due date, there is a great reason to move on with these matters immediately.

Call us today for a cost-free examination and also learn even more. car.

In between medical expenses, lost earnings, repair services to your automobile as well as lots of various other expenses, you may be having a hard time under a substantial financial weight as you attempt to restore your life. When a person else triggers your crash, you should not have to pay for their mistakes.

You may pick to spend for extra protection. Nevertheless, holding this no-fault protection means you can not take legal action against to recoup clinical costs, shed earnings, pain as well as suffering or various other injury-related costs from the at-fault vehicle driver, unless among the complying with exceptions applies: Your medical expenses exceed $1,000. You received a broken bone.

Unknown Facts About Understanding Illinois Car Accident Compensation - Coplan ...

The individual agent of the estate of an individual eliminated in a fatal auto accident can likewise demand problems. You can pick to deny the constraints on your right to sue by finishing a no-fault rejection kind and also sending it to the Division of Insurance coverage. If you deny those restrictions, you will certainly not obtain your no-fault PIP benefits, however you are qualified to seek compensation from the at-fault motorist after being hurt in any type of mishap.

https://www.youtube.com/embed/Zb9eSkqinDI

But really recovering that compensation can be tough. If you have not opted out of your no-fault advantages, an insurance firm might challenge whether your injuries are serious sufficient to cross the lawful limit and enable you to take legal action against. And regardless, they might contest the level of your injuries or suggest that you were actually liable for your mishap.

Some Known Facts About Average Car Insurance Costs In 2021 - Ramseysolutions.com.

What good is a policy if the company does not have the wherewithal to pay an insurance claim? To run a check on a particular insurer, consider examining out a site that rates the financial toughness of insurance coverage business.

In general, the less miles you drive your car per year, the lower your insurance policy price is likely to be, so constantly ask about a business's gas mileage limits. Usage Mass Transit When you authorize up for insurance, the business will generally begin with a set of questions.

Find out the specific rates to insure the different lorries you're thinking about prior to buying. 7. Boost Your Deductibles When choosing cars and truck insurance policy, you can typically choose a deductible, which is the amount of money you would need to pay before insurance policy foots the bill in the event of a crash, theft, or other kinds of damage to the lorry.

8. Improve Your Credit score Ranking A motorist's document is certainly a huge element in establishing automobile insurance prices. After all, it makes feeling that a motorist that has remained in a lot of mishaps might cost the insurer a great deal of cash. cars. Nonetheless, folks are sometimes stunned to locate that insurer might additionally think about credit history ratings when determining insurance premiums.

It's a contentious problem in specific statehouses ... cheaper auto insurance. [] insurance companies will state their researches show that if you're responsible in your personal life, you're less likely to submit insurance claims." No matter whether that's real, be aware that your credit report ranking can be a consider figuring insurance policy costs, and also do your utmost to keep it high.

The Only Guide for How Much Does Car Insurance Cost In May 2022? - Cnet

You can check credit report records completely free at Annual, Credit Report, Record. com 9. Consider Area When Approximating Cars And Truck Insurance Policy Rates It's not likely that you will certainly relocate to a various state just due to the fact that it has reduced cars and truck insurance rates. When intending an action, the prospective adjustment in your auto insurance coverage price is something you will certainly want to factor right into your budget.

If the worth of the auto is only $1,000 and the crash coverage costs $500 per year, it might not make sense to purchase it. GEICO, for example, provides a "possible financial savings" of 25% if you have an anti-theft system in your vehicle.

Vehicle alarms and also Lo, Jacks are 2 kinds of devices you might intend to inquire about. If your primary motivation for mounting an anti-theft gadget is to decrease your insurance premium, consider whether the price of adding the device will certainly cause a significant sufficient cost savings to be worth the difficulty as well as cost.

Talk with Your Agent It is necessary to note that there may be various other price savings to be had in addition to the ones defined in this article. As a matter of fact, that's why it often makes feeling to ask if there are any kind of unique price cuts the firm supplies, such as for armed forces personnel or workers of a specific firm.

Nevertheless, there are several points you can do to decrease the sting. These 15 suggestions should obtain you driving in the ideal instructions. Remember also to contrast the finest automobile insurer to find the one that fits your protection requirements as well as budget plan.

Some Ideas on Essentials Of Health Policy And Law - Page 182 - Google Books Result You Need To Know

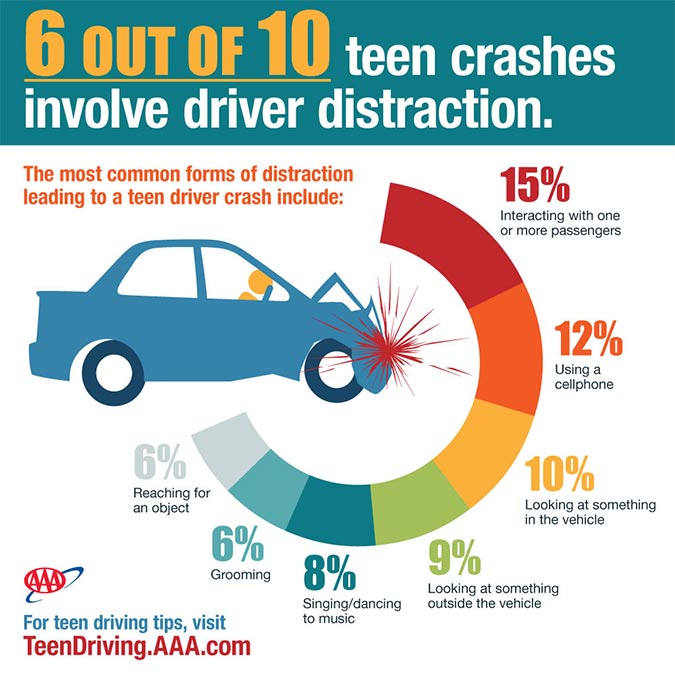

Insurance policy providers intend to see demonstrated liable habits, which is why traffic mishaps as well as more info citations are factors in establishing vehicle insurance rates. Bear in mind that aims on your license don't stay there forever, however exactly how lengthy they stay on your driving record differs depending on the state you stay in as well as the seriousness of the infraction.

cheaper cars vehicle insurance insurance

cheaper cars vehicle insurance insurance

For example, a brand-new sporting activities automobile will likely be extra expensive than, say, a five-year-old car. If you pick a reduced deductible, it will cause a greater insurance costs which makes picking a greater insurance deductible appear like a rather excellent offer. A greater deductible could mean paying more out of pocket in the event of a crash (suvs).

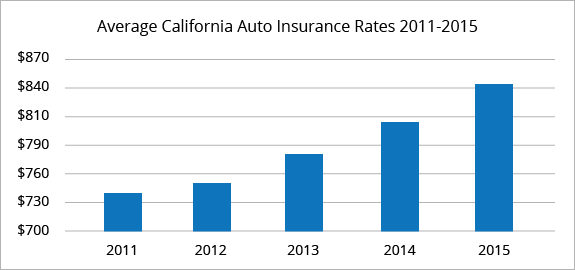

What is the typical cars and truck insurance coverage price? There are a large variety of variables that influence just how much auto insurance expenses, that makes it tough to get an accurate concept of what the average person spends for car insurance policy - car insurance. According to the American Auto Association (AAA), the typical expense to insure a car in 2016 was $1222 a year, or around $102 each month.

Exactly how do I obtain vehicle insurance policy? Obtaining an auto insurance coverage quote from Nationwide has never ever been simpler.

When it concerns elements that influence the ordinary car insurance coverage price, there are some elements that you can manage, at least partially. This consists of things like where you live as well as what your credit rating is. However, there are certain factors you can't control. And the most apparent element is your age.

The Cheap Car Insurance Of May 2022 – Forbes Advisor Statements

cheaper cheapest car auto insurance insurance affordable

cheaper cheapest car auto insurance insurance affordable

For instance, vehicle insurance is typically at its greatest when you are a teenage chauffeur, and also the rates may continue to be high until you are concerning 25. Also within the 16-25 age range, you'll see these rates go down. At age 20, the ordinary chauffeur can anticipate to pay about $3300 for full protection.

The typical price of vehicle insurance in the USA is $2,388 per year or $199 each month, according to information from virtually 100,000 policyholders from Savvy - liability. The state you reside in, the degree of coverage you would love to have, and also your gender, age, credit rating, and driving background will all aspect right into your premium.

Insurance is regulated at the state level, and also laws on called for coverage as well as prices are different in every state. Insurance coverage business take into account lots of different variables, including the state and location where you live, as well as your gender, age, driving history, and the degree of protection you would certainly like to have.

Right here are the largest elements that will certainly influence the price you'll pay for coverage, and also what to think about when checking out your automobile insurance policy alternatives. Maintain in mind that there have been some big changes to car insurance policy expenses during the coronavirus pandemic. Some auto insurers are offering discount rates as Americans drive much less, and also are likewise helping people influenced by the virus delay repayments.

Organization Expert put with each other a list of typical vehicle insurance policy rates for each state. Here's a range auto insurance coverage expenses by state.

Little Known Questions About Average Car Insurance Costs In 2021 - Ramseysolutions.com.

As Well As from Service Expert's data, car insurance coverage firms often tend to charge females much more. Service Expert gathered quotes from Allstate as well as State Ranch for fundamental insurance coverage for male and women chauffeurs with a similar profile in Austin, Texas. When exchanging out just the gender, the male account was priced estimate $1,069 for coverage per year, while the women account was priced quote $1,124 annually for protection, costing the female vehicle driver 5% more.

In states where X is a gender option on motorist's licenses including Oregon, The golden state, Maine, as well as soon New York insurers are still establishing just how to compute expenses. Average auto insurance premiums by age, The number of years you've been driving will affect the rate you'll pay for protection. While an 18-year-old's insurance standards $2,667.

low cost auto business insurance automobile business insurance

low cost auto business insurance automobile business insurance

This information was provided to Company Insider by Savvy (insurance). How auto insurance prices change with the variety of vehicles you possess, In some methods, it's logical: the a lot more automobiles you have on your policy, the greater your auto insurance bills. There are additionally some cost savings when several cars are on one policy.

Cars and truck insurance policy is cheaper in zip codes that are much more rural, and also the exact same is real at the state level. Guarantee. com information shows that Iowa, Idaho, Wisconsin, and Maine have the most affordable vehicle insurance policy of all states, which's since they're a lot more rural states. Other variables that can impact the expense of cars and truck insurance policy There are a couple of other elements that will add to your costs, including: If you don't drive numerous miles annually, you're less most likely to be entailed in a crash.

Each insurance policy company looks at all of these variables and rates your insurance coverage in a different way as a result. Obtain quotes from several different automobile insurance policy firms and contrast them to make certain you're obtaining the ideal bargain for you. cheap insurance.

Some Known Incorrect Statements About Average Car Insurance In Ontario By Month, Age And Gender

In this write-up, we'll discover just how ordinary auto insurance coverage prices by age as well as state can rise and fall. We'll likewise have a look at which of the finest car insurance policy firms provide great discounts on car insurance by age and contrast them side-by-side. Whenever you look for automobile insurance coverage, we suggest obtaining quotes from multiple suppliers so you can contrast insurance coverage as well as prices (low cost).

business insurance insurers risks car

business insurance insurers risks car

Why do typical auto insurance policy rates by age vary so much? 5 percent of the population in 2017 yet stood for 8 percent of the overall price of cars and truck accident injuries.

The price data comes from the AAA Foundation for Web Traffic Security, and also it represents any kind of accident that was reported to the police. The average premium data comes from the Zebra's State of Automobile Insurance record. The rates are for policies with 50/100/50 responsibility insurance coverage limitations as well as a $500 deductible for thorough and also collision protection - insurance affordable.

auto vehicle cheaper cheapest car

auto vehicle cheaper cheapest car

According to the National Highway Website Traffic Safety Administration, 85-year-old men are 40 percent more probable to enter into a crash than 75-year-old men - accident. Considering the table over, you can see that there is a direct relationship between the collision price for an age group as well as that age's ordinary insurance policy premium.

Remember, you may discover better prices via another business that doesn't have a details student or elderly discount rate - car insurance. * The Hartford is only offered to members of the American Association of Retired Persons (AARP). Insurance policy holders can add more youthful vehicle drivers to their policy as well as obtain discount rates. Typical Auto Insurance Rates As Well As Cheapest Provider In Each State Due to the fact that automobile protection prices vary so a lot from one state to another, the company that uses the cheapest vehicle insurance coverage in one state may not use the most affordable coverage in your state.

The Only Guide for Low Congestion, Cheaper Car Insurance Makes Raleigh A Top ...

As you can see, average car insurance policy expenses differ commonly by state. Idahoans pay the least for cars and truck insurance, while vehicle drivers in Michigan shell out the huge dollars for protection.

If you live in downtown Des Moines, your costs will most likely be even more than the state average (insured car). On the other hand, if you reside in upstate New York, your vehicle insurance coverage will likely set you back much less than the state average. Within states, cars and truck insurance coverage costs can vary widely city by city.

https://www.youtube.com/embed/B912eQle9co

However, the state isn't among one of the most costly overall. Minimum Insurance coverage Needs Many states have monetary obligation regulations that need chauffeurs to carry minimal auto insurance coverage. You can only forego coverage in two states Virginia and New Hampshire but you are still economically in charge of the damages that you trigger.

How Deductible Fund: How It Works - Liberty Mutual can Save You Time, Stress, and Money.

Understanding when to adjust your deductible as well as when to look around for a new cars and truck insurer with cost effective prices is the best method to avoid high costs in the future. Our Recommendations For Vehicle Insurance Searching for auto insurance coverage doesn't have to be tough. Just ensure to get quotes from multiple suppliers, so you can compare rates.

perks credit score cars low-cost auto insurance

perks credit score cars low-cost auto insurance